An asset manager launching a crypto-currency index fund has raised $4 million in its seed round.

Founded this year in San Francisco, partners with family offices, financial advisors and investment managers seeking to tap returns on crypto-currencies.

Yesterday, the firm announced the launch of the Bitwise HOLD 10 Private Index Fund. It will hold the 10 most valuable crypto-currencies, selected and weighted by market capitalization.

The fund rebalances monthly, capitalizes on hard forks and air drops, and is a low-cost way to gain exposure to crypto-currencies, Bitwise Asset Management said in a statement.

"As crypto-currencies become more mainstream, a private index fund, like Bitwise, is an incredibly important step to simplifying the complexities in the space and making it more accessible," said investor Keith Rabois.

According to a recent survey by Harris Poll on behalf of Blockchain Capital, less than 2 per cent of investors own bitcoin. Interest is significant, though, with 19 per cent of respondents saying that will buy bitcoin in the next five years. Interest is higher among Millennials – those aged between 18 and 34 – at 32 per cent.

"While interest has been growing significantly, crypto-assets are still in the early stages of adoption and development as an asset class. Access to the category is still difficult and limited," Bitwise Asset Management chief executive, Hunter Horsley, said.

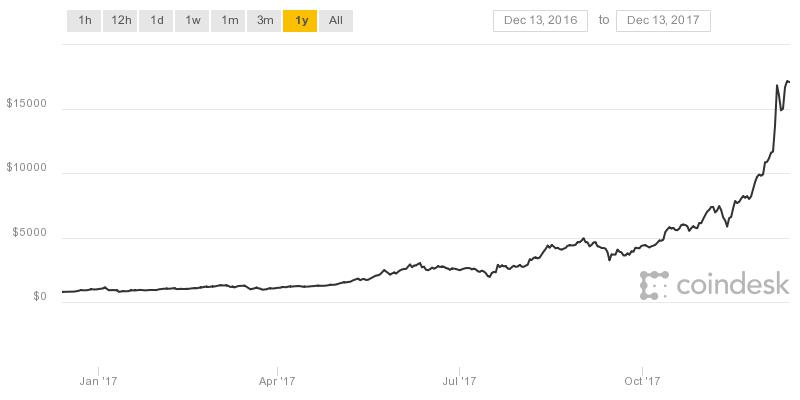

From rags to riches: Bitcoin's growth year-to-date

Over the past year, billions of dollars have flooded into crypto-currencies as their frequent price swings have lured investors seeking liquidity and those looking to cash in on a quick profit.

The market cap of all crypto-currencies is $498 billion, with bitcoin accounting for $283 billion of the total figure, according to CoinMarketCap.com. A single bitcoin now costs nearly $17,000, while this time last year the crypto-currency was valued at around $770.

Earlier this week, bitcoin landed on Wall Street when Cboe Group launched bitcoin futures on one of its exchanges. Its larger rival, CME Group, is expected to list its own bitcoin futures next week.

There are now over 100 hedge funds investing purely in bitcoin, according to AutonomousNEXT.

Ethereum, the second-largest crypto-currency, has seen its value rocket more than 6000 per cent over the past year, while litecoin, in third place, has also enjoyed strong price gains.

All are extremely volatile, however, and often suffer daily price fluctuations of more than 20 per cent.